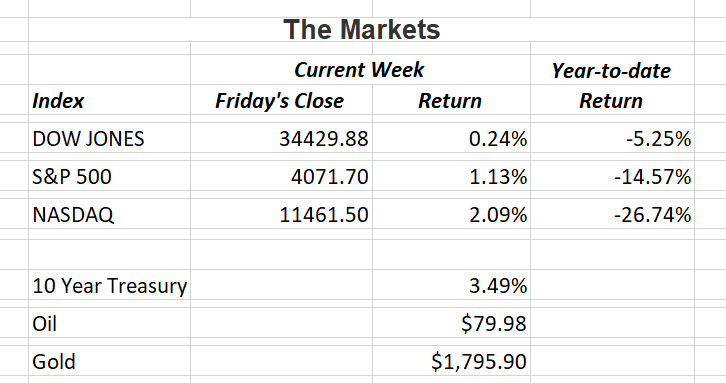

U.S. stocks ended the week up slightly as the major indices rallied on good news one day and sold off the next day on concerning news. As we enter December, investors continue to hope for a Santa Claus rally. With only three weeks remaining before jolly old St. Nick makes his Christmas Eve appearance, we’re running out of time.

The good news first. Fed Chairman Jerome Powell provided a clear signal the the central bank is on track to increase interest rates by 0.50% at its next meeting on December 13-14. The news sent the Dow Jones Industrial Average skyrocketing 737 points on Wednesday. Investors believe the Fed may now take a wait and see position as we move into the new year to see what effect their 2022 rate increases will have on slowing down inflation.

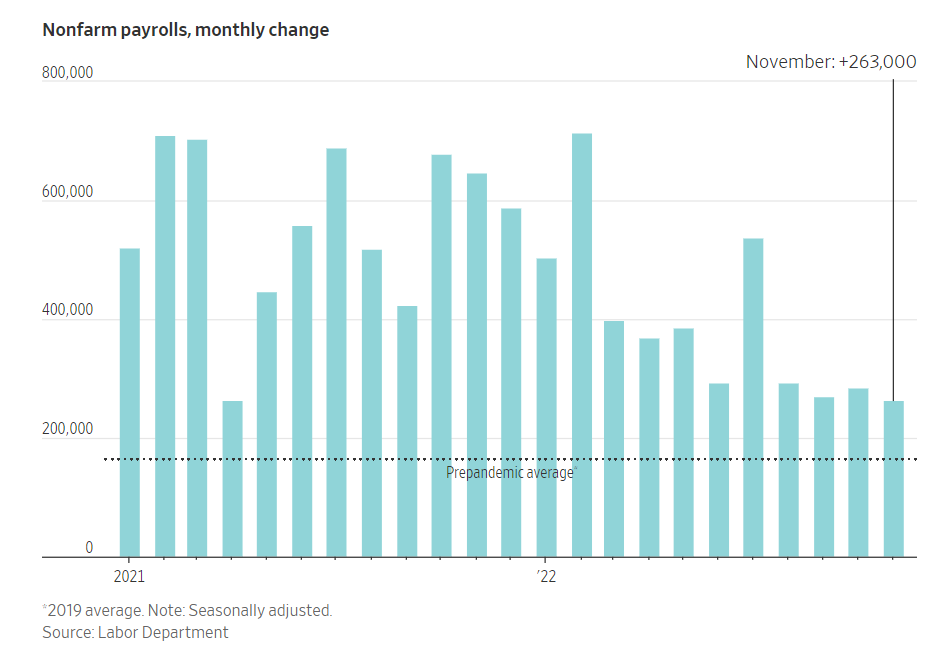

The concerning news came on Friday as high demand for U.S. workers may continue to fan the flame of inflation and cause the Fed to raise interest rates more aggressively in 2023. Employers added 263,000 jobs in November holding near the strong gains of the three previous months. Workers continue to be in high demand as there are still over 10 million jobs available domestically. The official unemployment rate remained at 3.7%.

The chart below from the U.S. Labor Department shows that job growth has leveled off but remains historically high.

If you have any questions, please contact me

The Markets and Economy

- Home prices in the S. fell in September from the prior month, marking the first time prices have declined for three straight months in nearly four years.

- A strange divergence is taking place in the energy sector. We all know the price of crude has been dropping to well below $80 a barre That has those of us filling up at the pump very happy. However, oil futures (the price of oil to be delivered at some future date) for February are running in the upper $80 range. Analysts at JPMorgan, Morgan Stanley and UBS are forecasting oil to soar back over $100 a barrel by the end of 2023. Geopolitical instability and continued demand in industrialized nations are cited as the main reasons for higher anticipated prices.

- Domestic instability and labor activism are creating problems for the world’s second-largest economy. China is facing growing discontent from it’s population protesting working conditions and lockdowns over Beijing’s zero-tolerance Covid Also, China’s economy contracted further in November adding pressure to the economy and government officials.

- Gross Domestic Product rose 2.9% in the third quarter. That’s up from the previously reported growth rate of 2.6%. Larger consumer spending and increased business investment were behind the growth revision.

- S. life insurers paid a record $100 billion in 2021 in death benefits. The payouts mostly due to Covid related deaths comes on the heels of a then record $90.43 billion in 2020.

- Burned by Covid lockdowns and worker unrest, Apple is looking to expand its manufacturing operations outside of China.

The House and the Senate both passed a deal to avert a railroad strike. The deal forces unions to accept an earlier labor agreement mediated by the administration. The bill was sent to President Biden where it was signed into law preventing workers from walking off the job weeks before the holiday season. If railway workers were allowed to strike, it is estimated it would cost the U.S. economy $2 billion a day.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.